On Thursday, February 22, the provincial government announced the Budget for the year 2024/25. This new budget builds on the province’s commitment to bringing affordable housing solutions to British Columbians by expanding or increasing the budget for previously announced provincial housing measures that have earned recognition across the country. However, there are some omissions and opportunities for improvement that are worth highlighting.

Last year, the Housing Central alliance submitted a consultation paper to the province with our recommendations for the 2024/25 Budget, which included:

- Support the Aboriginal Housing Management Association’s Urban Rural and Northern Indigenous Housing Strategy, allocating funding for the planning and implementation stages of the key actions dedicated to addressing Indigenous housing across the province:

Indigenous people in BC are disproportionally represented in many negative indicators including lower average incomes, higher unemployment rates, higher rate (47%) of core housing need in lone-parent families, and overrepresentation in homelessness.

- Dedicate $24 million to offset the Property Transfer Tax (PTT) of co-op lease renewals and Rental Protection Fund transactions, including $10 million to compensate PTT payments resulting from transactions by non-profits supported by the RPF before the 2024/25 Budget enters into effect.

In 2023 the province allocated $500 million to kickstart the Rental Protection Fund, enabling the community housing sector to acquire older rental buildings to protect their affordability in perpetuity. By eliminating PTT for non-profits and housing co-operatives, the sector will be better positioned to maintain the current level of affordability.

- Allocate $60 million to exempt non-profit housing providers from paying property tax by updating the BC Assessment classification of non-profit housing properties in line with the preferential property tax rates currently exclusive to Class 3 – Supportive Housing Providers.

Under the current classification, non-profit housing providers pay as much in property taxes as any other corporate landlord, despite not being driven by the same motives and fulfilling a different role in the community. This tax can represent a significant portion of the operating budget of a non-profit housing society, one that could be directed to addressing staffing challenges or providing deeper levels of affordability.

These recommendations represented Housing Central’s key strategies to address upcoming challenges and opportunities from the community housing sector.

Understanding the announcements in BC Budget 2024

If BC Budget 2023 was a historically pro-housing budget, BC Budget 2024 builds on the investments made and further strengthens BC Builds, the provincial housing strategy introduced last year. This year’s budget includes measures that aim to discourage speculative activity and encourage a healthier housing environment.

Housing Flipping Tax

One of the main announcements in BC Budget 2024 was the introduction of a Flipping Tax, which will impose up to a 20% charge on any “profit made from selling a residential property within two years of buying it.” The revenue generated will be re-directed to fund new homes. Coming into effect on January 1st, 2025, the province estimates that the tax will generate around $11 million by the end of the fiscal year, and in 2025/26 it will increase to $43 million.

Although it is great to see the province taking action to discourage speculation and finding ways to increase the funds available to support affordable housing, it is fair to say that this measure is not likely to have a large impact on the housing affordability crisis.

Property Transfer Tax (PTT) Exemptions

BC Budget 2024 introduced a few amendments to the PTT that aim to reduce the cost of purchasing residential properties. We welcome the new PTT exemption “for new, eligible purpose-built rental buildings between January 1, 2025 and December 31, 2030” as it will lower costs across the sector. The province estimates a loss of $4 million in tax revenue through this exemption.

However, we are disappointed that the exemption only applies to new purpose-built rental buildings and excludes older buildings at risk of losing the affordable units already being delivered, which are the target of the Rental Protection Fund. Unfortunately, the Fund’s first acquisitions, two housing co-ops in Coquitlam and an Esquimalt building to be operated by Lu’ma Native Housing Society, are subject to significant PTT costs. Pairing of the cost-savings of a PTT exemption with the support of the Rental Protection Fund could have had a big impact on the level of affordability for community housing sector operators.

The remaining PTT changes introduced are targeted to first-time home buyers and purchases of newly built homes, which accounted for 7% and 12% respectively of the transactions of residential properties in 2023 according to available data from the government. Together, these changes are expected to reduce the tax revenue by $102 million. We would have preferred to see a more balanced distribution of these exemptions, prioritizing transactions that create or secure existing affordable homes for British Columbians.

Capital Investments

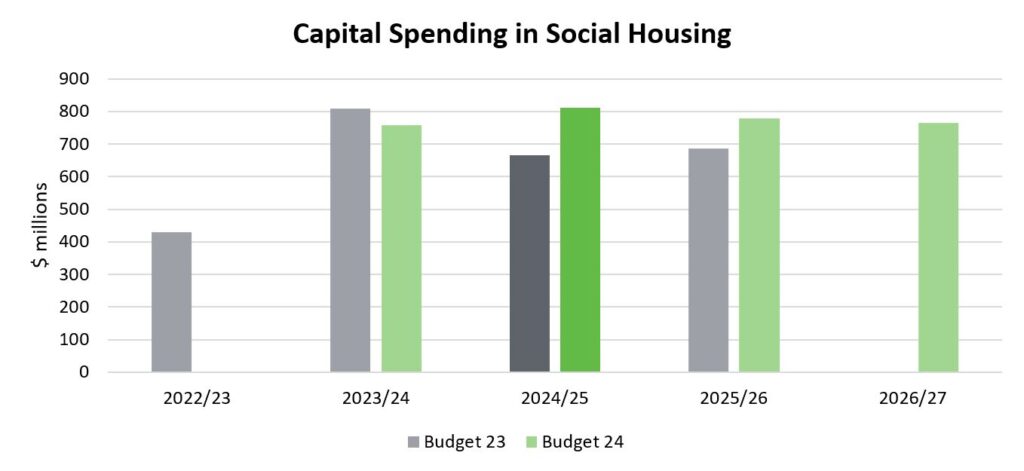

Lastly, BC Budget 2024 increases the spending capacity for capital investments in social housing for the upcoming fiscal year by $146 million compared to what was planned in the 2023/24 Budget. It includes a series of commitments to increase capital and operative funding for BC Builds ($48 million and $150 million respectively), as well as incremental funding to maintain over 500 temporary and permanent shelter spaces across the province, including ongoing shelter spaces in Kelowna, Williams Lake and Merritt.

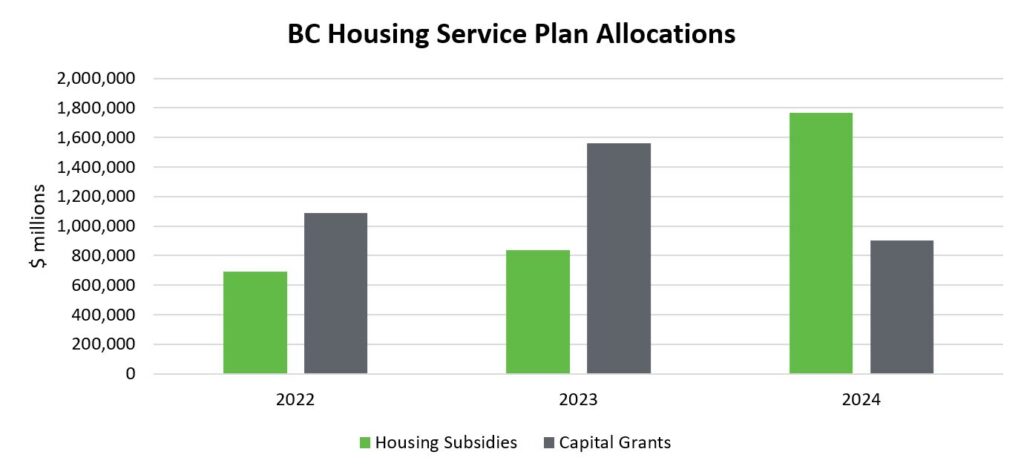

According to BC Housing’s three-year service plan, this year’s budget introduced a significant change in the approach to spending across the different areas of BC Housing’s budget. This year the amount allocated to housing subsidies represents 57% of the total planned expenditure while capital grants received 29%; in the past two years, capital grants was allocated more funding than housing subsidies. In this shift, the budget for housing subsidies nearly doubled from $835 million to $1.8 billion and the budget for capital grants saw a reduction of more than 40%.

Missed Opportunity

One of the most important omissions in BC Budget 2024 is funding for the Aboriginal Housing Management Association’s Urban, Rural and Northern Indigenous Strategy or any Indigenous-specific housing program. The BC government has a key role in advancing Indigenous housing targets identified in the Strategy by providing funds for an Indigenous Co-op Housing Program and for wraparound services for Indigenous-led organizations, as well as prioritizing investments in supportive housing directed at For Indigenous, By Indigenous organizations.

What Makes us Optimistic?

Looking at the year ahead, we are still optimistic for the community housing sector. Although the new budget missed some opportunities to increase support in key areas of need, it builds on a historically pro-housing provincial budget from 2023/24 and follows a set of pro-housing legislation changes that are changing the housing outlook for the region, including:

- Small-Scale Multi-Family Housing

- Transit-Oriented Development Areas

- Municipal Housing Targets

- Pro-active planning, including Housing Needs Assessments and Official Community Plans

- Development finance

These measures, despite not providing direct funding, can have a significant impact on the ease, speed, and willingness of local governments to approve more affordable housing in their communities, which has been identified as one of the major roadblocks in increasing the stock of the community housing sector. It is clear, however, that in the face of significant need there is still much more that can be done. When it comes to providing affordable homes individuals and families in need, the provincial government – along with their federal and municipal counterparts – must find new ways to channel funds to non-profit housing providers.

Moreover, we anticipate that in the months leading to the provincial elections planned for October 2024, the government will make new housing announcements as they recognize it remains the top priority for all British Columbians. BCNPHA will continue advocating on the sector’s behalf to ensure effective solutions for those in greatest housing need.