Federal Budget 2019 continues to stay the course, providing the investments for the National Housing Strategy that were announced in Budget 2017. This year’s budget also provides some supplemental policy and funding initiatives that have important implications for the affordable housing sector in Canada. We’ve summarized these changes below, focusing on the matters most pertinent to the rental housing sector and then moving on to issues affecting home owners.

Expansion of the Rental Construction Financing Initiative (RCFI)

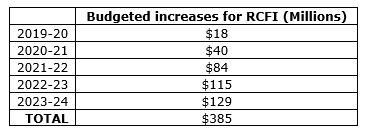

Budget 2019 provides a funding increase to the CMHC’s Rental Construction Financing Initiative, a program that provides low-cost loans to build affordable, accessible, and energy efficient housing projects. The budget states it will provide a $10-billion increase to the program over 10 years that, if realized, will help construct 42,500 new rental units across the country. While the 10-year commitment is mentioned, Budget 2019 only provides detailed funding projections to 2024 (shown below).

Housing Supply Challenge

Budget 2019 provides $300 million to develop a Housing Supply Challenge that will invite municipalities and stakeholder groups across the country to propose “new ways to break down barriers that limit the creation of new housing.” CMHC and Infrastructure Canada will work together to develop the challenge, with more information being made available in the summer of 2019.

Expert panel on housing supply and affordability

The expert panel on affordable housing is a BC-focused initiative that will consult with stakeholders in the province to better identify and evaluate additional measures that could increase affordable housing supply in high-cost communities throughout BC. The panel will be comprised of a variety of experts from different areas of the housing field, and they will be selected jointly by the governments of Canada and British Columbia. More information on the expert panel will follow in the coming months.

Delivering the National Housing Strategy

Budget 2019 proposes to introduce new legislation that will make it mandatory for the federal government to maintain a National Housing Strategy that prioritizes the needs of Canada’s most vulnerable residents, and will require regular reporting on goals and outcomes of the strategy to Parliament. There is currently no timetable for the introduction of this legislation.

Strengthening enforcement of tax evasion, money laundering, and mortgage fraud

Budget 2019 provides the Canada Revenue Agency with $50 million over five years to institute four new residential and commercial audit teams in BC and Ontario. These teams will ensure that tax provisions related to real estate are being followed, thereby clamping down on tax evasion.

The federal government is also committing to working with provincial partners to deter financial crime in real estate, through improving the data collection of parties purchasing and selling commercial and residential property. The ultimate aim of these measures is to increase oversight and enforcement of federal and provincial law as it relates to money laundering, mortgage fraud, and tax evasion. As a part of these initiatives, Budget 2019 will provide up to $1 million over two years to Statistics Canada to conduct a comprehensive data needs assessment to better understand where there are gaps in knowledge about the real estate system.

Support for first-time home buyers

CMHC first-time home buyer incentive program

This program will provide up to $100 million over five years in loans to provide shared equity mortgages to first-time home buyers. CMHC offers qualified first-time home buyers with a 10 percent shared equity mortgage for a newly constructed home, or 5 percent for an existing home. The aim of the program is to reduce the carrying costs of mortgages for younger home buyers who are now shut out of the market.

The First Time Home Buyer Plan, first introduced in 1992, allows first-time home buyers to borrow money from their RRSPs for a down payment on a home. Budget 2019 increases the amount individuals can extract from their RRSP, from $25,000 to $35,000.